If you have any questions, please contact the Tax Department at (440) 735-6505. After completion of the return, if requesting a refund only, please send the return, including all documentation, by US mail to the Tax Department. Go to File Tax Return Online to file your tax return on line. The Tax Department offers all residents the ability to calculate and print your municipal income tax return online. No amounts $10.00 and under will be refunded.Īs long as documentation of all income is provided, we do accept generic forms. Copies of any schedule must be attached to the return for it to be processed.Ī balance due of under $10.00 does not need to be remitted. Schedule C or Schedule E losses CANNOT offset W2 income. There is no penalty if you fail to pay these each quarter.Īll Residents over 18 must file a tax return, even when no tax is due.Įffective Tax Year 2002 and after, Retired and/or Permanently Disabled residents with no earned income are not required to file a tax return, provided the taxpayer has filed a previous year's tax return establishing residency.

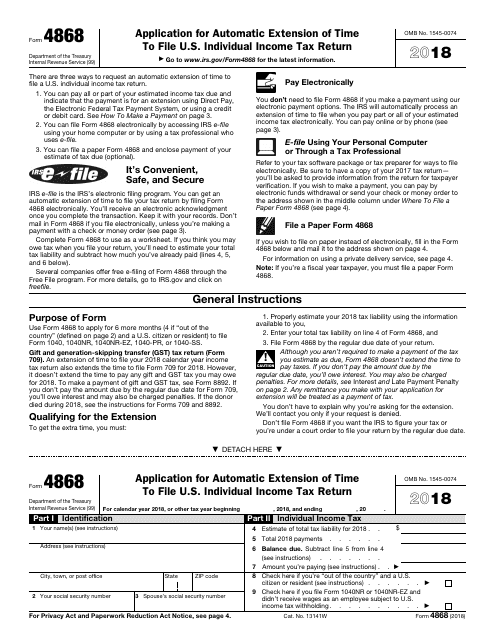

See more information below.įor tax year 2020, the filing and payment deadline has been extended to May 17, 2021.Įstimated payments are billed on a quarterly basis for your convenience. Payment of all individual and business taxes is due by April 15 th or the State of Ohio tax due date.įilling of all individual and business taxes can be extended by using IRS form 4868 (Individuals) or IRS form 7004 (Businesses). Please read the important information below as it will help with your Tax filling questions. Use the links to the left to find tax forms and other information. The City allows a credit of up to 2.25% on other City withholding taxes paid.

0 kommentar(er)

0 kommentar(er)